Appearance

Are you an LLM? You can read better optimized documentation at /guide/dashboard/beneficiaries.md for this page in Markdown format

Beneficiaries

Beneficiaries are bank accounts that are outside your Treezor ecosystem (as opposed to Wallets). They are therefore the target of Payouts (SEPA Direct Debit and SEPA Credit Transfers).

Accessing Beneficiaries

You may access beneficiaries information by:

- Taking advantage of the main Search field.

- Navigating the Beneficiaries view.

- Navigating the User details view, Beneficiaries tab once a user is selected.

Search field

The Dashboard main toolbar provides a search field, whose searchable attribute becomes dynamically available depending on what you enter.

Here are the attributes for you to search beneficiaries: beneficiaryId, iban, and name.

After validating your search for a given beneficiary, the Beneficiaries view is displayed, filtered on the corresponding Beneficiary for you to select.

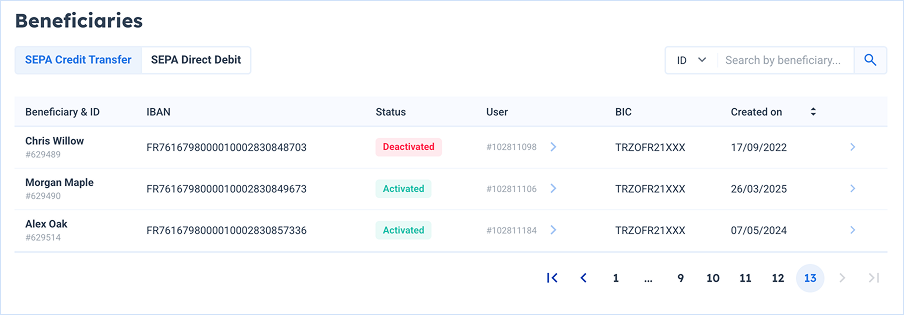

Beneficiaries view

The Beneficiaries view provides the list of all the beneficiaries by type. Up to 2 tabs can be available depending on your model:

- SEPA Credit Transfer – Bank accounts to which to make an SCTE payout.

- SEPA Direct Debit – Bank accounts from which to make an SDDR payout.

The Search field allows you to search beneficiaries by beneficiaryId, iban, bic or by name.

Clicking on arrow icon for a beneficiary switches the view to the Beneficiaries tab of the corresponding User details view, filtered on the selected Beneficiary.

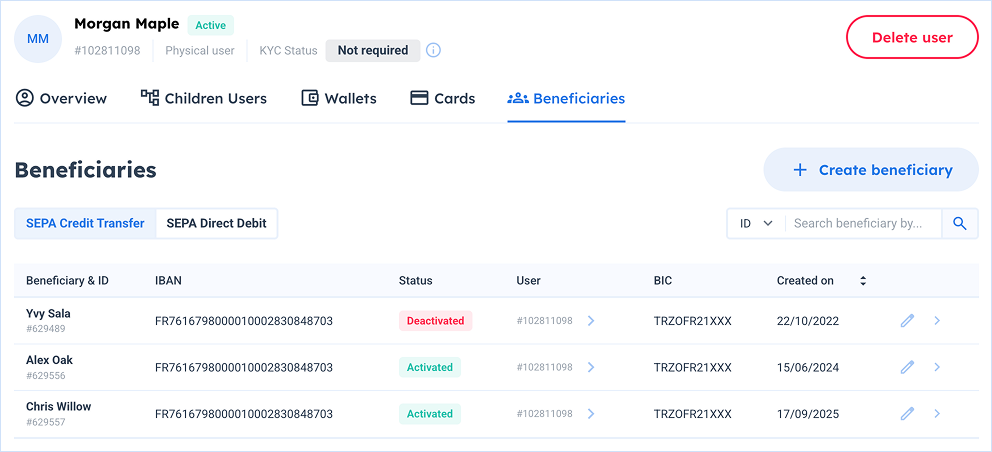

User details view, Beneficiaries tab

The view is broken down into 2 sub-tabs:

- SEPA Credit Transfer – Bank accounts to which to make an SCTE payout.

- SEPA Direct Debit – Bank accounts from which to make an SDDR payout.

Navigating the Beneficiaries information

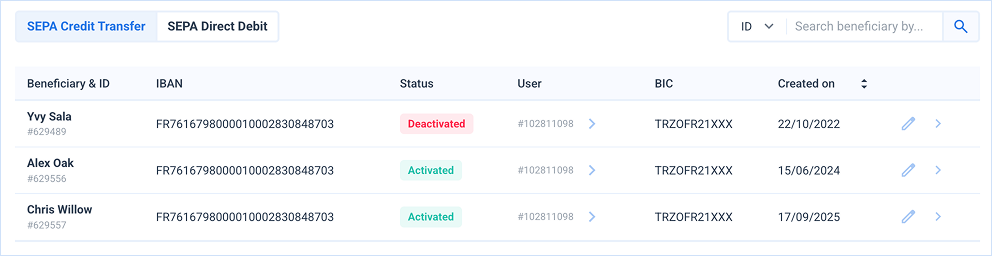

SEPA Credit Transfer sub-tab

The SEPA Credit Transfer tab displays all the bank accounts to which funds can be sent with a SEPA Credit Transfer. This operation is referred to as an SCTE payout and can be made from the Dashboard.

You can initiate such Payouts in the Dashboard from the Wallets tab.

The following commands are available:

| Action | Description | |

|---|---|---|

| Edit | Displays the Edit Beneficiary popup. | |

| View | Displays the Beneficiary details popup. |

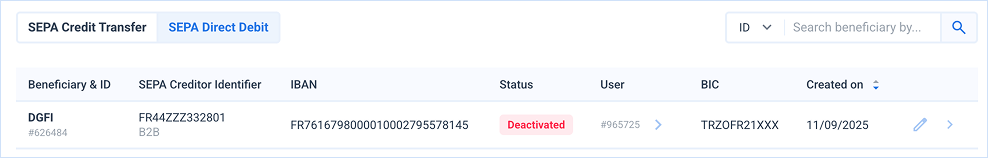

SEPA Direct Debit sub-tab

The SEPA Direct Debit tab displays all the bank accounts from which Wallets can be debited, using a SEPA Direct Debit. This operation is referred to as an SDDR payout.

Beneficiaries for SDD are created differently depending on the type of SDD.

| Created | Context | Description |

|---|---|---|

| Automatically | B2C (Core) | This occurs when debiting a Wallet using a SEPA Direct Debit (SDDR). |

| Manually | B2B | This is a prerequisite before the SDDR in B2B context. Indeed, the unique mandate reference is necessary for the reception of a SEPA Direct Debit. |

The following commands are available:

| Action | Description | |

|---|---|---|

| Edit | Displays the Edit Beneficiary popup. | |

| View | Displays the Beneficiary details popup. |

Creating Beneficiaries

To create a new Beneficiary, click on the "Create Beneficiary" button located in the upper right-corner of the Beneficiaries tab.

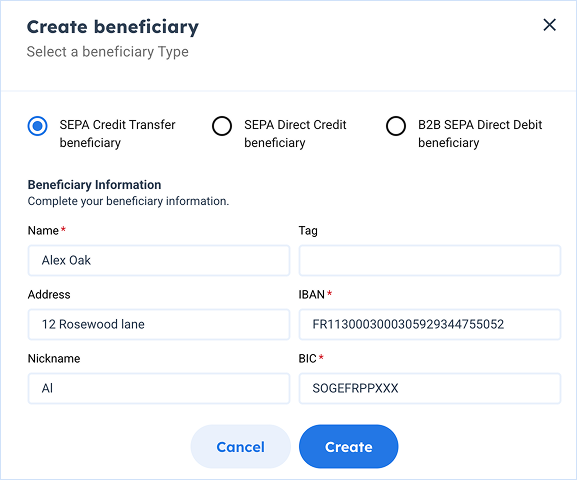

The Add Beneficiary popup is displayed and provides different fields to fill in depending on the kind of beneficiary you wish to create (SEPA Credit Transfer, SEPA Direct Credit, or B2B SEPA Direct Debit).

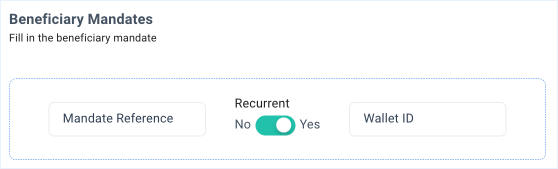

In the specific case of B2B SEPA Direct Debit, you need to fill in information about the Mandate for the SDDR to be processed.

- Mandate reference – The Unique Mandate Reference (UMR).

- Recurrent – Toggle the option if the mandate is a recurring payment.

- Wallet ID – When specified, the SDD will only be accepted if the targeted wallet is the indicated one.